In case you missed the Nikkei article “For Ricoh, it’s a sink-or-swim moment” I shared earlier today on Facebook and Twitter, here are a few quotes:

“Ricoh is staring at huge losses as the market for multifunctional printers, Ricoh’s cash cow, evaporates and its global sales network racks up high costs.”

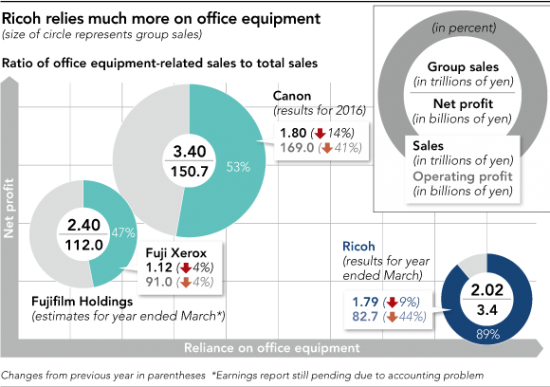

“The Imaging and Solutions division, which primarily handles multifunctional printers, contributes 90% of Ricoh’s consolidated sales. For the fiscal year that ended in March, the division’s profit plunged, lowering Ricoh’s operating profit to sales ratio to 4.6%. This is less than half the ratio at Canon, which suffered a setback in the same segment.”

“Today, Ricoh cannot improve earnings without drastically cutting costs at its sales force, but the division holds an awful lot of sway inside the company.”